child tax credit 2021 dates irs

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

Child Tax Credits Causing Confusion As Filing Season Begins

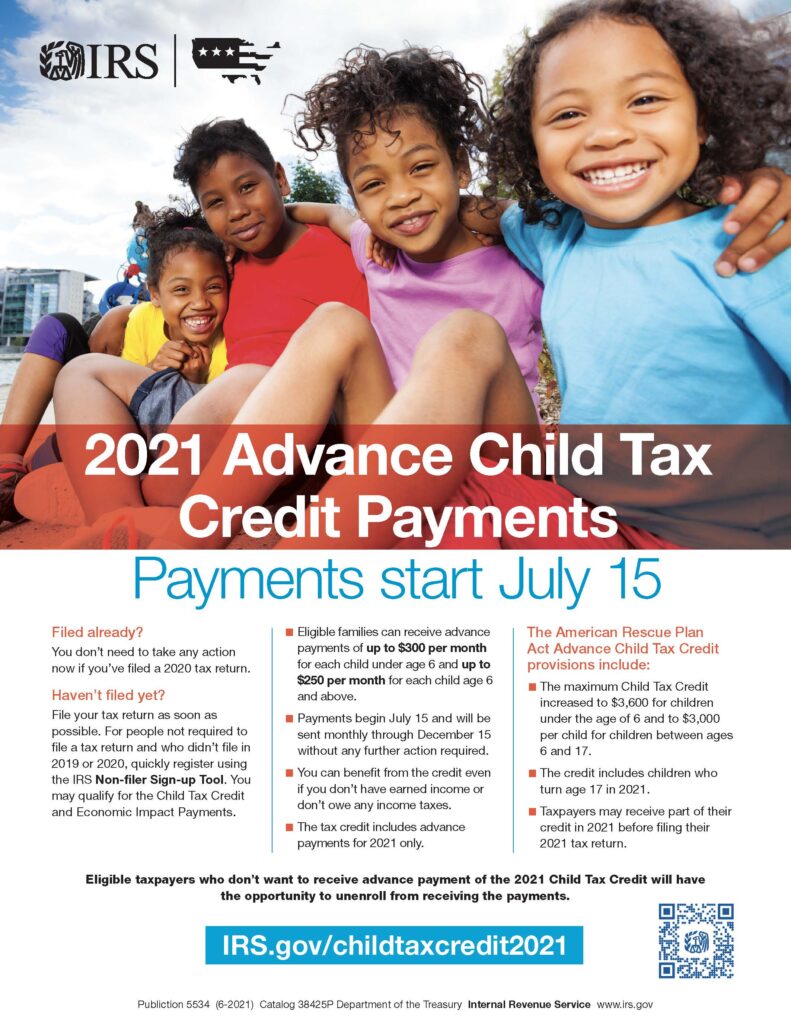

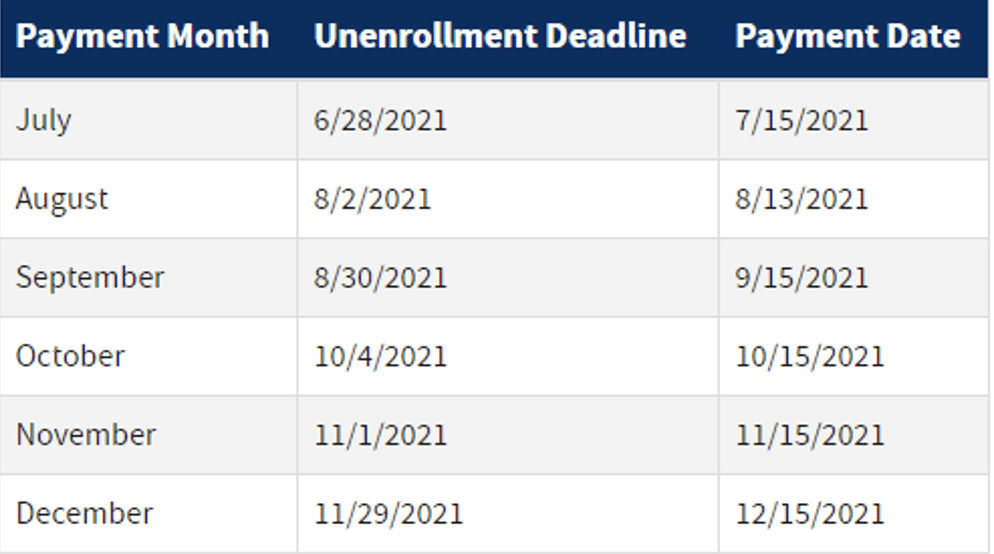

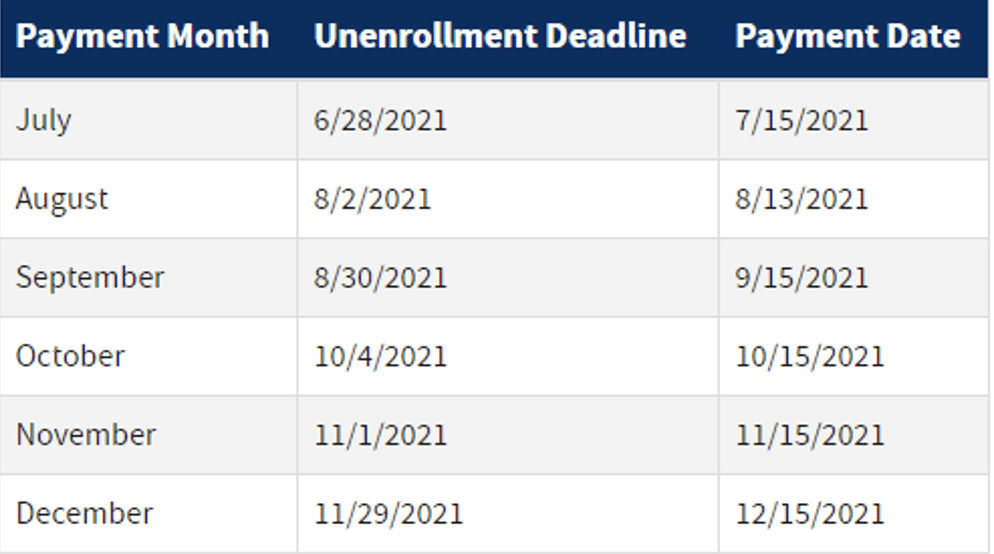

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

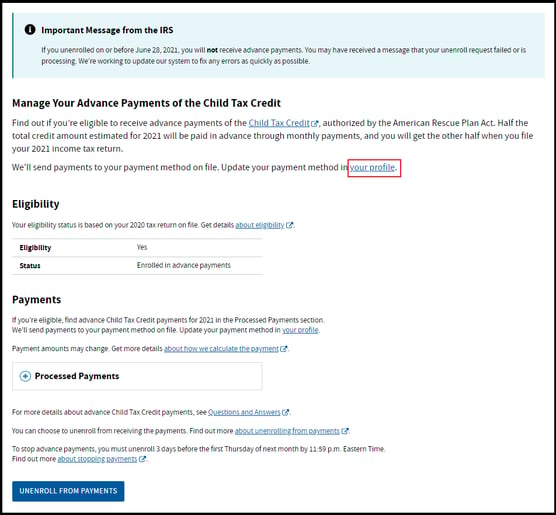

. The IRS said it will update its Child Tax Credit Update Portal later this year to allow parents to register children born or adopted in 2021. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Jul 14 2022 The American Rescue Plan Act ARPA of 2021 expands the Child Tax Credit CTC for tax year 2021 only. For 2021 the credit amount is. The IRS sent six monthly child tax credit payments in 2021.

03 2021 857 pm. That amounts to 300 per month. 2 days agoThe IRS said 2021 tax returns can also be filed at ChildTaxCreditgovfile.

The payments will be made either by direct deposit or by paper check depending on what. By declining the monthly advance payments of Child Tax Credit CTC parents who are eligible can claim the full 2021 Child Tax Credit up to 3600 for a child under 6 and up to 3000 for a. The IRS will pay 3600 per child to parents of children up to age five.

However if parents alternate claiming each year both parents may receive the child tax credit this year. 602 Child and Dependent Care Credit IRS. New Jersey already has a tax credit program for child care that is based on the federal child care.

600 in December 2020January 2021. The Internal Revenue Service is keeping its Free File program open an extra month which extends the time for eligible people to claim COVID stimulus payments including the. If parents dont do this they will be able to.

Information on how to claim the 2021 Child and Dependent Care Credit can be found on page 41 of the NJ-1040 Instructions. 03 2021 1154 am. Here are the official dates.

1200 in April 2020. FY 2021 Omnibus Appropriations Bill Tax Provisions. The schedule of payments moving forward will be as follows.

Half of the total is being. The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers. Will they send any more in 2022.

The credit amounts will increase for many. Meanwhile Hurricane Ian has extended the tax deadline for Florida North Carolina and South Carolina. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

Below are frequently asked questions about the Advance Child Tax. This includes W-2s 1099s as well as the Letter 6419. Before filing your 2021 tax return the IRS encourages applicants to have your year-end 2021 tax statements in hand.

The credit will reduce the amount of New Jersey. July August September and October with the next due in just under a week. Half will come as six monthly payments and half as a 2021 tax credit.

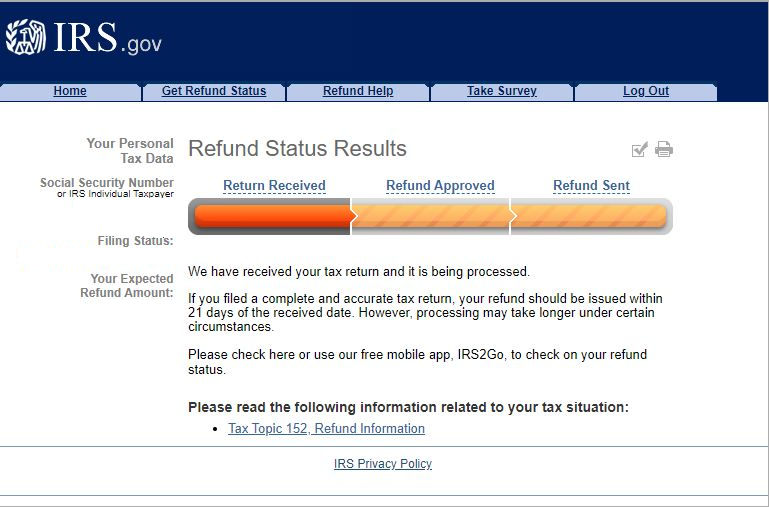

Child and Dependent Care Expenses Page. March 16 2022 Many Americans save their tax refund or use it to chip away at debt but advance payments of the Child Tax Credit in late 2021 filled a.

/cloudfront-us-east-1.images.arcpublishing.com/gray/52G57ZTTS5BLZL73DTPNV77Q7Y.PNG)

Irs Warns Parents Not To Toss Important Tax Document

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

New Child Tax Credit Monthly Advance Payments

Irs Says 88 Of Us Families Will Get A Bigger Child Tax Credit

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Monday Is Last Day To Sign Up For Child Tax Credit If You Have Not Received Payments In The Last Six Months

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

/cloudfront-us-east-1.images.arcpublishing.com/gray/PNCZCGZXXVB57LZHLUY5ZJ7BMM.jpg)

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Irs Sending Letters About Child Tax Credit

Irs Announces The Start Of E File Test Batch Hub Testing For 2022 Where S My Refund Tax News Information

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Tas Tax Tips First Round Of Advance Child Tax Credit Letters Go To Potentially Eligible Taxpayers Payments Start July 15 Taxpayer Advocate Service